Why Should I Buy a Business Rather Than Start One?

An existing business has a track record. The failure rate in small business is largely in the start-up phase.

The existing business has demonstrated that there is a need for that product or service in a particular locale. Financial records are available along with other information on the business.

Most sellers will stay and train a new owner and most will also supply financing.

Finding someone who will teach you the intricacies of running a business and who is also willing to finance the sale can make all the difference.

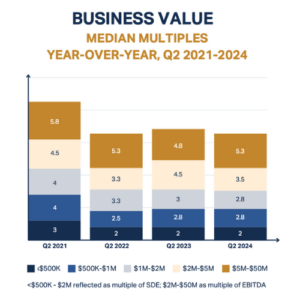

Interest rates and business valuation multiples are closely linked, as financing costs significantly impact a buyer’s ability to pay higher prices for businesses. In Q2 2021, multiples were at an all-time high due to historically low interest rates, which made borrowing cheaper and increased business values. However, as interest rates began to rise, multiples dropped by an average of 30% by Q2 2022. Since then, they have remained fairly stagnant as buyers faced higher borrowing costs, which dampened their purchasing power.

Owning a business and owning the right kind of business for you are, of course, two wildly different things. Owning the wrong kind of business can make you absolutely miserable. So if you are considering buying a business, it is prudent that you invest the time and effort into determining the best kind of business for your needs and your personality. In a recent Forbes article, “What is the Right Type of Business for You to Buy?” author Richard Parker explores how buyers should go about finding the right business fit.

Parker is definitely an expert when it comes to working with buyers as he has spoken with an estimated 100,000 buyers over his career. In that time, Parker has concluded that it is critical that you don’t “learn on your own time.”

His key piece of advice concerning what type of business to buy is as follows. “While there are many factors to be considered, the answer is simple: whatever it is you do best has to be the single most important driving factor of the revenues and profits of any business you consider purchasing.” And he also believes that expertise is more important than experience. Parker’s view is that it is critical for prospective buyers to perform an honest self-assessment in order to identify their single greatest business skill and area of expertise. The last thing you want to do is pretend to be something that you are not.

Parker makes one very astute point when he notes, “Small business owners generally wear many hats: this is usually why their businesses remain small. Remember that every big business was once a small business.” As Parker points out, whoever is in charge of the business will ultimately determine how the business will evolve, or not evolve. Selecting the right business for you and your skillsets is pivotal for the long-term success of your business.

All of this adds up to make the process of due diligence absolutely essential. Before buying a business, you must understand every aspect of that business and make certain that the business is indeed a good fit for you. According to Parker, if you don’t love your business, it will have trouble growing. This point is impossible to refute. Owning and growing a business requires a tremendous amount of time and effort. If you don’t enjoy owning and/or operating your business, success will be a much more difficult proposition.

Finding the right business for you is a complicated process even after you have performed a proper evaluation of your skills and interests. After all, do you really want a solid business with great potential for growth that you would hate owning? By working with brokers and M&A advisors, you can find the best business fit for your needs, personality, and goals. These professionals are invaluable allies in the process of discovering the right business for you.

Copyright: Business Brokerage Press, Inc.

The post Finding the Best Business for You appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

There have been many surveys taken in an attempt to answer this question. Most surveys reveal the same responses, in almost the same identical order of priority. Here are the results of a typical survey, listed in order of importance:

1. To do my own thing, control my own destiny.

2. Don’t want to work for someone else.

3. To better utilize my skills and abilities.

4. To make money.

*It is interesting to note that money is not at the top of the list, but comes in fourth.

A recent article on Businessbroker.net entitled, First Time Buyer Processes by business broker Pat Jones explores the process of buying a business in a precise step-by-step fashion. Jones notes that there are many reasons that people buy businesses including the desire to be one’s own boss. However, he is also quick to point out that buyers should refrain from buying a business that they simply don’t like. In the quest for profits, many prospective owners may opt to do this, but it could ultimately lead to failure.

Step One – Information Gathering

For Jones, there are seven steps in the business buying process. At the top of the list is to gather information on businesses so that one has an idea of what kind of businesses are appealing.

Step Two – Your Broker

The second key step is to begin working with a business broker. This point makes tremendous sense; after all, those new to the business buying process will benefit greatly from working with a guide with so much experience. Business brokers can gain access to information that prospective business owners simply cannot.

Step Three – Confidentiality and Questions

The third step in the process is to sign a confidentiality agreement so that you can learn more about a business that you find interesting. Once you have the businesses marketing package, you’ll want to have your broker schedule an appointment with the seller. It is vitally important that you prepare a list of questions on a range of topics. There is much more to buying a business than the final price tag. By asking the right questions, you’ll be able to learn more about the business and its long-term potential.

Step Four – Evaluation

In the fourth step of the business buying process, you’ll want to evaluate all the information that you have received from the seller. Once again, a business broker can be simply invaluable, thanks to years of hands-on experience, he or she will know how to evaluate a seller’s information.

Step Five – The Decision

In the fifth step, you’ll need to decide whether or not you are making an offer. If you are making an offer, you will, of course, want it to be written and include contingencies.

If your offer is accepted, then the process of due diligence begins. During due diligence, you and your business broker will look at everything from financial statements to tax returns. You will evaluate the company’s assets. Again business brokers are experts at the due diligence process.

Buying a business is an enormous commitment. Making certain that you’ve selected the right business for you is one of the most critical decisions of your life. Having as much competent and experienced help as possible is of paramount importance.

A professional business broker can be helpful in many ways. They can provide you with a selection of different and, in many cases, unique businesses, including many that you would not be able to find on your own. Approximately 90 percent of those who buy businesses end up with something completely different from the business that they first inquired about. Business brokers can offer you a wide variety of businesses to look at and consider.

Business brokers are also an excellent source of information about small business and the business buying process. They are familiar with the market and can advise you about trends, pricing and what is happening locally. Your business broker will handle all of the details of the business sale and will do everything possible to guide you in the right direction, including, if necessary, consulting other professionals who may be able to assist you.

Your local professional business broker is the best person to talk to about your business needs and requirements.

Where your money is concerned, myths can do damage. A recent Divestopedia article from Tammie Miller entitled, Crazy M&A Myths You Need to Stop Believing Now, Miller explores 5 big M&A myths that can get you in trouble. Miller points out that many of these myths are believed by CEOs, but that they have zero basis in reality.

Myth 1

The first major myth Miller explores is the idea that the “negotiating is over once you sign the LOI.” The letter of intention is, of course, important. However, this is by no means the end of the negotiations and it is potentially dangerous to think otherwise. The negotiations are not concluded until there is a purchasing agreement in place. As Miller points out, there is a great deal that can go wrong during the due diligence process. For this reason, it is important to not see the LOI as the “end of the road.”

Myth 2

Another myth that Miller wants you to be aware of is that you don’t have to take a company’s debt as part of the purchase price. Many business brokers, such as Miller, recommend that buyers don’t take seller paper.

Myth 3

A third myth that Miller explorers is a particularly dangerous one. The idea that everyone who makes an offer has the money to follow through is, unfortunately, simply not true. Oftentimes, people will make offers without securing the money to actually buy the business. No doubt, this wastes everyone’s time. As the business owner, it can derail your progress. If you are not careful, it could actually prevent you from finding a qualified buyer.

Myth 4

Another myth is built around the notion that sellers don’t need a deal team in order to sell their business. Again, this is another myth that has no real foundation in reality. While it may be possible to sell your business without the assistance of an experienced M&A attorney or business broker, the odds are excellent that doing so will come at a price. According to Miller, those working with an investment banker or business broker can expect, on average, 20% more transaction value!

Additionally, there are other dangers in not having a deal team in place. A business broker can handle many of the time-consuming aspects of selling a business, so that you can keep running your business. It is not uncommon for business owners to get stretched too thin while trying to both run and sell a business and this can ultimately harm its value.

Myth 5

Miller’s final myth to consider is that you must sell your entire business. It is true that most buyers will want to buy 100% of a business, but a minority ownership position is still an option. There are many reasons to consider selling a minority stake, so don’t assume that selling your business is an “all or nothing” affair.

Ultimately, Miller lays out an exceptional case for the importance of working with business brokers when selling or buying a business. Business brokers can help you avoid myths. In the end, they know the lay of the land.

Certainly, you need adequate capital to buy the business and to make the improvements you want, along with maintaining some reserves in case things start off slowly. You need to be willing to work hard and, in many cases, to put in long hours. Unfortunately, many of today’s buyers are not willing to do what it takes to be successful in owning a business. A business owner has to, as they say, be the janitor, errand boy, employee, bookkeeper and “chief bottle washer!” Too many people think they can buy a business and then just sit behind a desk and work on their business plans. Owners of small businesses must be “doers.”

Obviously, you want to consider only those businesses that you would feel comfortable owning and operating. “Pride of Ownership” is an important ingredient for success. You also want to consider only those businesses that you can afford with the cash you have available. In addition, the business you buy must be able to supply you with enough income – after making payments on it – to pay your bills. However, you should look at a business with an eye toward what you can do with it – how you can improve it and make it more productive and profitable. There is an old adage advising that you shouldn’t buy a business unless you feel you can do better than the present owner. Everyone has seen examples of a business that needs improvement in order to thrive, and a new owner comes in and does just that. Conversely, there are also cases where a new owner takes over a very successful business and not soon after, it either closes or is sold. It all depends on you!

Buying a business can be an exciting prospect. For many prospective business owners, owning a business is the fulfillment of a decades long dream. With all of that excitement comes considerable emotion. For this reason, it is essential to step back and carefully evaluate several key factors to help you decide whether or not you are making the best financial and life decision for you. In this article, we’ll examine five key factors you should consider before buying a business.

What is Being Sold?

If you hate the idea of owning a clothing store, then why buy one? The bottom line is that you have to have a degree of enthusiasm about what you are buying otherwise you’ll experience burnout and lose interest in the business.

How Good is the Business Plan?

Before getting too excited about owning a business, you’ll want to take a look at the business plan. You’ll want to know the current business owner’s goals and how they plan on going about achieving those goals. If they’ve not been able to formulate a coherent business plan then that could be a red flag.

You need to see how a business can be grown in the future, and that means you need a business plan. Additionally, a business plan will outline how products and services are marketed and how the business compares to other companies.

How is Overall Performance?

A key question to have answered before signing on the bottom line is “How well is a business performing overall?” Wrapped up in this question are factors such as how many hours the owner has to work, whether or not a manager is used to oversee operations, how many employees are paid overtime, whether or not employees are living up to their potential and other factors. Answering these questions will give you a better idea of what to expect if you buy the business.

What Do the Financials Look Like?

Clearly, it is essential to understand the financials of the business. You’ll want to see everything from profit and loss statements and balance sheets to income tax returns and more. In short, don’t leave any rock unturned. Importantly, if you are not provided accurate financial information don’t hesitate, run the other way!

What are the Demographics?

Understanding your prospective customers is essential to understanding your business. If the current owner doesn’t understand the business, that is a key problem. It should be clear who the customers are, why they keep coming back and how you can potentially add and retain current customers in the future. After all, at the end of the day, the customer is what your business is all about.

Don’t rush into buying a business. Instead, carefully evaluate every aspect of the business and how owning the business will impact both your life and your long-term financial prospects.

Generally, at the outset, a prospective seller will ask the business broker what he or she thinks the business will sell for. The business broker usually explains that a review of the financial information will be necessary before a price, or a range of prices, can be suggested for the business.

Most sellers have some idea about what they feel their business should sell for – and this is certainly taken into consideration. However, the business broker is familiar with market considerations and, by reviewing the financial records of the business, can make a recommendation of what he or she feels the market will dictate. A range is normally set with a low and high price. The more cash demanded by the seller, the lower the selling price; the smaller the cash requirements of the seller, the higher the price.

Since most business sales are seller-financed, the down payment and terms of the sale are very important. In many cases, how the sale of the business is structured is more important than the actual selling price of the business. Too many buyers make the mistake of being overly-concerned about the full price when the terms of the sale can make the difference between success and failure.

An oft-quoted anecdote may better illustrate this point: If you could buy a business that would provide you with more net profit than you thought possible even after subtracting the debt service to the seller, and you could purchase this business with a very small down payment, would you really care what the full price of the business was?

The initial response to the question in the title really should be: “Why do you want to know the value of your business?” This response is not intended to be flippant, but is a question that really needs to be answered.

- Does an owner need to know for estate purposes?

- Does the bank want to know for lending purposes?

- Is the owner entertaining bringing in a partner or partners?

- Is the owner thinking of selling?

- Is a divorce or partnership dispute occurring?

- Is a valuation needed for a buy-sell agreement?

There are many other reasons why knowing the value of the business may be important.

Valuing a business can be dependent on why there is a need for it, since there are almost as many different definitions of valuation as there are reasons to obtain one. For example, in a divorce or partnership breakup, each side has a vested interest in the value of the business. If the husband is the owner, he wants as low a value as possible, while his spouse wants the highest value. Likewise, if a business partner is selling half of his business to the other partner, the departing partner would want as high a value as possible.

In the case of a business loan, a lender values the business based on what he could sell the business for in order to recapture the amount of the loan. This may be just the amount of the hard assets, namely fixtures and equipment, receivables, real estate or other similar assets.

In most cases, with the possible exception of the loan value, the applicable value definition would be Fair Market Value, normally defined as: “The price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.” This definition is used by most courts.

It is interesting that in the most common definition of value, it starts off with, “The price…” Most business owners, when using the term value, really mean price. They basically want to know, “How much can I get for it if I decide to sell?” Of course, if there are legal issues, a valuation is also likely needed. In most cases, however, what the owner is looking for is a price. Unfortunately, until the business sells, there really isn’t a price.

The International Business Brokers Association (IBBA) defines price as; “The total of all consideration passed at any time between the buyer and the seller for an ownership interest in a business enterprise and may include, but is not limited to, all remuneration for tangible and intangible assets such as furniture, equipment, supplies, inventory, working capital, non-competition agreements, employment, and/or consultation agreements, licenses, customer lists, franchise fees, assumed liabilities, stock options or stock redemptions, real estate, leases, royalties, earn-outs, and future considerations.”

In short, value is something that may have to be defended, and something on which not everyone may agree. Price is very simple – it is what something sold for. It may have been negotiated; it may be the seller’s or buyer’s perception of value and the point at which their perceptions coincided (at least enough for a closing to take place) or a court may have decided.

The moral here is for a business owner to be careful what he or she asks for. Do you need a valuation, or do you just want to know what someone thinks your business will sell for?

Business brokers can be a big help in establishing value or price.

When you find a business, the business broker will be able to answer many of your questions immediately or will research them for you. Once you get your preliminary questions answered, the typical next step is for the broker to prepare an offer based on the price and terms you feel are appropriate. This offer will generally be subject to your approval of the actual books and records supporting the figures that have been supplied to you. The main purpose of the offer is to see if the seller is willing to accept the price and terms you offered.

There isn’t much point in continuing if you and the seller can’t get together on price and terms. The offer is then presented to the seller who can approve it, reject it, or counter it with his or her own offer. You, obviously, have the decision of accepting the counter proposal from the seller or rejecting it and going on to consider other businesses.

If you and the seller agree on the price and terms, the next step is for you to do your “due diligence.” The burden is on you – the buyer – no one else. You may choose to bring in other outside advisors or to do it on your own – the choice is yours. Once you have checked and approved those areas of concern, the closing documents can be prepared, and your purchase of the business can be successfully closed. You will now join many others who, like you, have chosen to become self-employed!

Before buying any business, a seller must ask questions, lots of questions. If there is ever a time where one should not be shy, it is when buying a business. In a recent article from Entrepreneur magazine entitled, “10 Questions You Must Ask Before Buying a Business”, author Jan Porter explores 10 of the single most important questions prospective buyers should be asking before signing on the dotted line. She points out to remember that “there are no stupid questions.”

The first question highlighted in this article is “What are your biggest challenges right now?” The fact is this is one of the single most prudent questions one could ask. If you want to reduce potential surprises, then ask this question.

“What would you have done differently?” is another question that can lead to great insights. Every business owner should be an expert regarding his or her own business. It only makes sense to tap into that expertise when one has the opportunity. The answers to this question may also illuminate areas of potential growth.

How a seller arrives at his or her asking price can reveal a great deal. Having to defend and outline why a business is worth a given price is a great way to determine whether or not the asking price is fair. In other words, a seller should be able to clearly defend the financials.

Porter’s fourth question is, “If you can’t sell, what will you do instead?” The answer to this question can give you insight into just how much bargaining power you may have.

A business’ financials couldn’t be any more important and will play a key role during due diligence. The question, “How will you document the financials of the business?” is key and should be asked and answered very early in the process. A clear paper trail is essential.

Buying a business isn’t all about the business or its owner. At first glance, this may sound like a strange statement, but the simple fact is that a business has to be a good fit for its buyer. That is why, Porter’s recommended question, “What skills or qualities do I need to run this business effectively?” couldn’t be any more important. A prospective buyer must be a good fit for a business or otherwise failure could result.

Now, here is a big question: “Do you have any past, pending or potential lawsuits?” Knowing whether or not you could be buying future headaches is clearly of enormous importance.

Porter believes that other key questions include: “How well documented are the procedures of the business?” and “How much does your business depend on a key customer or vendor?” as well as “What will employees do after the sale?”

When it comes to buying a business, questions are your friend. The more questions you ask, the more information you’ll have. The author quotes an experienced business owner who noted, “The more questions you ask, the less risk there will be.”

Business brokers are experts at knowing what kinds of questions to ask and when to ask them. This will help you obtain the right information so that you can ultimately make the best possible decision.

It may be advisable to have an attorney review the legal documents. It is important, however, that the attorney you hire is familiar with the business buying process and has the time available to handle the paperwork on a timely basis. If the attorney does not have experience in handling business sales, you may be paying for the attorney’s education. Most business brokers have lists of attorneys who are familiar with the business buying process. An experienced attorney can be of real assistance in making sure that all of the details are handled properly. Business brokers are not qualified to give legal advice.

However, keep in mind that many attorneys are not qualified to give business advice. Your attorney will be, and should be, looking after your interests; however, you need to remember that the seller’s interests must also be considered. If the attorney goes too far in trying to protect your interests, the seller’s attorney will instruct his or her client not to proceed. The transaction must be fair for all parties. The attorney works for you, and you must have a say in how everything is done.

If you know someone who has owned their own business for a period of time, he or she may also be a valuable resource in answering your questions about how small business really works.

You have to make the final decision; that “leap of faith” between looking and actually being in business for yourself is a decision that only you can make!

There is no doubt about it, it can be exciting to buy a new business. However, in the process, it is very important that you don’t become unrealistic about future growth. Keep in mind that in the vast majority of cases, if a business is poised to quickly grow substantially, the seller would be far less interested in selling.

Richard Parker’s recent article for Forbes entitled “Don’t Be Delusional About Growth When Buying a Business” seeks to instill a smart degree of caution into prospective buyers. Parker notes that when evaluating a business and talking to the owner, many buyers come away with a sense that enormous growth is just “sitting there” waiting to be seized. In particular, Parker cautions those buyers who are buying into an industry that they know nothing about; those individuals should be very careful.

When buying into an industry where one has no familiarity, there can be a range of problems. The opportunities that you see may not have been tapped into by the existing owner for a range of reasons. You couldn’t possibly guess what these reasons might be without more of a knowledge base. Since you are an outsider, you likely lack the proper perspective and understanding. In turn, this means you may see growth opportunities that may not exist, as the seller may have already tried and failed. Summed up another way, until you actually own the business and are running it on a day to day basis, you simply can’t make a proper assessment of how best to grow that business.

The seductive lure of growth shouldn’t be the determining factor when you are looking for a business. A far more important and ultimately reliable factor is stability. The real question, the foundation of whether or not a business is a good purchase option, is whether or not the business will maintain its revenue and profit levels once you’ve signed on the dotted line and taken over. You want to be sure that the business doesn’t have to grow to remain viable.

As Parker points out, the majority of small business buyers will buy in a sector where they don’t have much experience, and that is fine. What is not fine is assuming that you can greatly grow the business. Of course, if new buyers can achieve that goal, that is great and certainly icing on the cake. But don’t depend on that growth.

In the end, everyone has some ideas that work and some that don’t. You may take over a business and, thanks to having a different perspective than the previous owner, are able to find ways to make that business grow. But realize that many of your ideas for growing the business may fail completely.

A professional business broker will be able to help you determine what business is best for you. A business broker will help keep you focused on what matters most and steer you clear of the mistakes that buyers frequently make when buying a business.

Leases should never be overlooked when it comes to buying or selling a business. After all, where your business is located and how long you can stay at that location plays a key role in the overall health of your business. It is easy to get lost with “larger” issues when buying or selling a business. But in terms of stability, few factors rank as high as that of a lease. Let’s explore some of the key facts you’ll want to keep in mind where leases are concerned.

The Different Kinds of Leases

In general, there are three different kinds of leases: sub-lease, new lease and the assignment of the lease. These leases clearly differ from one another, and each will impact a business in different ways.

A sub-lease is a lease within a lease. If you have a sub-lease then another party holds the original lease. It is very important to remember that in this situation the seller is the landlord. In general, sub-leasing will require that permission is granted by the original landlord. With a new lease, a lease has expired and the buyer must obtain a new lease from the landlord. Buyers will want to be certain that they have a lease in place before buying a new business otherwise they may have to relocate the business if the landlord refuses to offer a new lease.

The third lease option is the assignment of lease. Assignment of lease is the most common type of lease when it comes to selling a business. Under the assignment of lease, the buyer is granted the use of the location where the business is currently operating. In short, the seller assigns to the buyer the rights of the lease. It is important to note that the seller does not act as the landlord in this situation.

Understand All Lease Issues to Avoid Surprises

Early on in the buying process, buyers should work to understand all aspects of a business’s lease. No one wants an unwelcomed surprise when buying a business, for example, discovering that a business must be relocated due to lease issues.

Summed up, don’t ignore the critical importance of a business’s leasing situation. Whether you are buying or selling a business, it is in your best interest to clearly understand your lease situation. Buyers want stable leases with clearly defined rules and so do sellers, as sellers can use a stable leasing agreement as a strong sales tool.

In her recent April 20th, 2020 Forbes article, “Three Keys to Engaged, Productive Telework Teams,” author Rajshree Agarwal, who is a professor of Strategy and Entrepreneurship, explored how to get the most out of telework. This highly timely article covers some very important territory for many companies dealing with the COVID-19 pandemic. Let’s explore Agarwal’s key points so that you can help your team get the most out of telework.

Agarwal notes that people may tend to shy away from sharing personal information and feelings while in the office. But via video conferencing, the story can be different. For this and other reasons, it is necessary for employers to keep in mind that the dynamic between you and your employees may be different when you use video conferencing. This will also often be the case when your employees speak with one another.

She prudently cautions business owners from taking a “business-as-usual” approach to the COVID-19 situation, as it can make them look both unnecessarily cold and out of touch with reality. On the flip side, however, it is also important to not dwell on the negative aspects of the pandemic. Offering some sense of normalcy during the COVID-19 pandemic is a smart move as well.

How you use telework and video conferencing is, in part, about developing the correct balance. On one hand, you’ll want to acknowledge that the situation is serious and must be addressed. But on the other hand, you don’t want to dwell on the pandemic. After all, not effectively handling the work at hand could undermine your business and cause other problems for both you and your employees.

It is in everyone’s best interest to be smart, safe, and acknowledge the bizarreness of the current situation while striving to achieve business goals. The keyword here is “balance.” Agarwal states that “The combination of empathy and purpose unifies individuals, allowing team members to channel their efforts towards shared objectives and values. This is the best antidote for anxiety.”

From Agarwal’s perspective, there are three keys to making telework effective: communication, socialization, and flexibility. First, there has to be good communication. For example, people can’t simply ignore one another’s emails because they are working virtually. She points out that real-time meetings via Zoom or Skype can eliminate some communication issues, but not all.

The second factor to consider is socialization. As Agarwal points out “Engaged, productive teams also take time to socialize.” Working from home alters the typical modes and methods of socialization, but virtual interactions can be used to help people form and develop their social networks.

In short, socialization doesn’t have to end once telework begins. Used judiciously, socializing, and the bonds it creates between co-workers can still continue.

Agarwal’s third key is flexibility. Flexibility is critical, as all team members must adjust to what, for some, may be a fairly radical restructuring of their day-to-day work experience. Those who haven’t worked virtually before may find adjusting to be quite a challenge. Management should strive to be more flexible during telework caused by the COVID-19 pandemic. Trying to maintain the same top-down approach could prove to be problematic.

It goes without saying that telework presents challenges. However, the challenges it represents are not insurmountable. There are benefits to teleworking, and teams can use it to generate solutions that they might have not reached in the typical work environment.

Copyright: Business Brokerage Press

The post Improving Your Telework Habits appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Finding the money to start your own small business can be a challenge. Over the decades, countless people have turned to the Small Business Administration (SBA) for help. A recent Inc. Magazine article, “Kickstart Your Business Dreams with SBA Lending,” by BizBuySell President, Bob House, explored how SBA lending can be used to the buyer’s advantage.

The article covers the basics of an SBA loan and who should try to get one. House notes that the SBA doesn’t provide loans itself, but instead facilitates lending and even micro-lending with a range of partners. The loans are backed by the government, which means that lenders are more willing to offer a loan to an entrepreneur who might not typically qualify for one. The fact is that the SBA will cover 75% of a lender’s loss if the loan goes into default.

Entrepreneurs can benefit tremendously from this program. In some cases, an SBA loan even means skipping the need for collateral. SBA loans can be used for those looking to open a business, expand their existing business or open a franchise.

House points out that getting an SBA loan has much in common with receiving other types of loans. For example, it is necessary to be “bank ready.” By “bank ready,” House means that all of your financial documentation should be organized, clear to understand and ready to go.

Next, a buyer would need to check that he or she qualifies, find a lender and fill out the necessary SBA forms. In order to be eligible for an SBA loan, it is necessary that the business is a for-profit venture and that it will do business in the United States. Once the necessary forms have been submitted, it can take between 2 to 3 months for an application to be processed and potentially approved.

The simple fact is that the SBA helps thousands of people every year. If you are looking to buy a business or expand your current business, then working with the SBA could be exactly what you need. Of course, business brokers are experts on what it takes to buy. Working with a broker stands as one of the single best ways to turn the dream of owning a business into a reality.

An existing business has a track record. The failure rate in small business is largely in the start-up phase. The existing business has demonstrated that there is a need for that product or service in a particular locale. Financial records are available along with other information on the business. Most sellers will stay and train a new owner and most will also supply financing. Finding someone who will teach you the intricacies of running a business and who is also willing to finance the sale can make all the difference.

Not Seeing What You Are Looking For?

Ask a question and we will answer for all future inquiries.